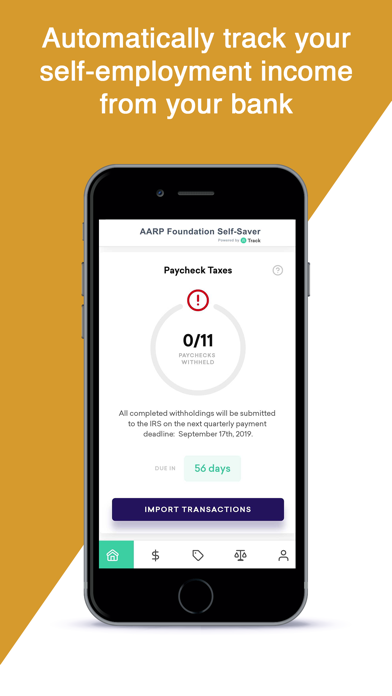

If you have self-employment income, tax prep and expense tracking just got easier! AARP Foundation Self-Saver™ is a bookkeeping and tax preparation tool to help you withhold and submit your quarterly taxes effortlessly. This AARP Foundation tool, powered by Track Technologies, aims to help self-employed people like you achieve financial independence and security.

Self-Saver works by calculating the taxes on every payment you receive, withholding the right amount, depositing it in an FDIC-ensured account, and submitting estimated quarterly taxes to the IRS. Self-Saver also gives you the option to organize your business expenses, which may help you reduce your overall tax bill.

SELF-SAVER IS PORTABLE

With the Self-Saver app you can manage your tax obligations from self-employment through your device -- from wherever you are!

SELF-SAVER IS UNIVERSAL

Self-employment income can come from many sources. Self-Saver is designed to assist with any type of self-employment income. Freelancers, realtors, electricians ... All can benefit from this tool.

SELF-SAVER IS AUTOMATED

Self-Saver gives you the flexibility to opt in or out of different levels of automation, including automatic withholding triggered by machine learning. With full automation, you’ll barely have to give taxes a second thought.

SELF-SAVER OFFERS SECURITY

With Self-Saver helping you manage your self-employment finances, you’ll feel more secure. By accounting for certain expenses and planning for taxes through Self-Saver, you may have a decreased risk of falling into debt or being unable to make timely tax payments.